It’s no secret the last few years greatly accelerated our dependence on technology as a society.

Customers are now most likely to interact with businesses through digital avenues first. Making those interactions high-value and seamless requires thoughtful design that leverages technology and accesses various aspects of an organization. The customers themselves want the opposite of complexity.

Customers are looking for intuitive interactions that solve problems quickly, with as little friction as possible. This creates an inverse relationship wherein providing customers with a weightless experience induces a heavy amount of internal orchestration.

On paper, this inverse relationship is like an iceberg. The tip peeking out of the water represents the interaction a customer has with an organization or product and the hulking mass hidden from sight signifies the amount of research, design, testing, developing, and iterating required to make that interaction happen.

As technology continues to become more intertwined with our daily existence (and more powerful), the tip of this iceberg is getting smaller.

Understanding this inverse relationship is highly beneficial, because it provides a fresh vantage point on how the various pieces of an organization might come together in order to provide better products and experiences to customers.

To thrive inside this inverse relationship, it’s crucial to find ways to connect all aspects of your organization and bring them into harmony.

Case study: Lemonade Found a Sweet Spot

If you’ve somehow missed them in the news, Lemonade was able to disrupt the insurance industry by adopting a unified, user-first and technology-second mindset led by conversational AI.

Just four years after launching, Lemonade reached one million customers in 2020 and currently offers at least one insurance product in every state in the U.S. Their success poses a looming threat to insurance giants like Allstate and StateFarm, which didn’t reach their one million customer mark for 19 and 22 years respectively.

Let’s unpack this phenomenon.

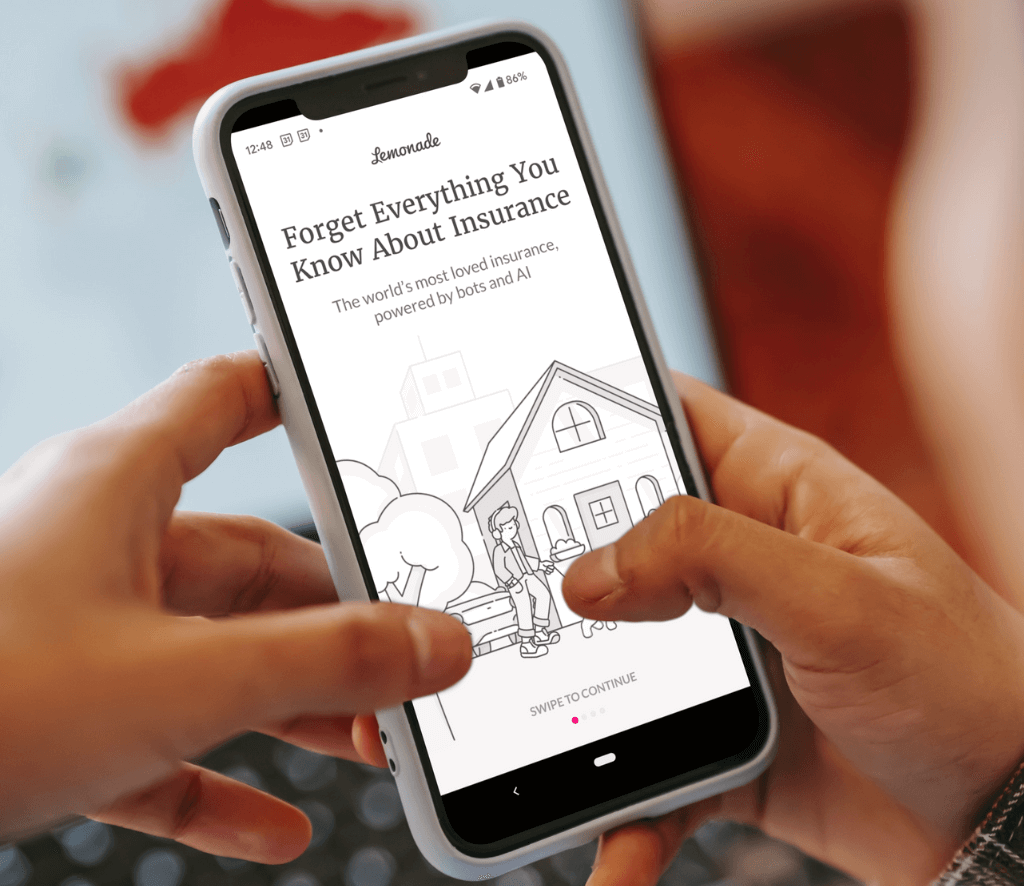

The tiny tip of Lemonade’s iceberg is Maya, a customer experience bot who walks people through the process of securing insurance (renter’s, homeowner’s, pet, or term life, with auto insurance on the way).

Maya does this by asking simple questions, one-at-a-time, as part of an ongoing conversation that collects the relevant information needed to issue a new, personalized insurance policy quickly and easily.

Maya is so good at its job, that there are blog posts devoted to the warm fuzzies users have for the conversational interface. The Lemonade experience also boasts a seemingly endless stream of positive tweets and a 4.9 average rating across the App Store and Google Play.

Under the water, Maya’s iceberg is part of a “customer cortex” that connects to vast amounts of internal and external data that allow the bot to quickly make situational determinations on the price and availability of policies.

This ecosystem is also home to Jim, the bot that handles customer claims.

“Jim’s AI tracks loads of user-generated data-points to help us identify suspicious activity and predict what our customers need before they even know it,” Wininger writes in the blog post mentioned above. “In the first month or so, our system tracked 3.7 million signals.”

Together, Maya and Jim provide seamless experiences that promise customers zero paperwork and quick policy payouts (“90 seconds to get insured; 3 minutes to get paid”).

You might even get an alert from Maya if there’s a threat, like fire, in the area.

While it’s true much of Lemonade’s success is tied to advanced technologies like conversational AI and machine learning — technologies many organizations are still just getting acquainted with — the key takeaway is they found a way to connect all of their internal departments to the central idea that technology can provide a better insurance-buying experience.

Designing a digital product that was connected to every aspect of their business gave Lemonade more than just satisfied customers who actually enjoyed buying insurance.

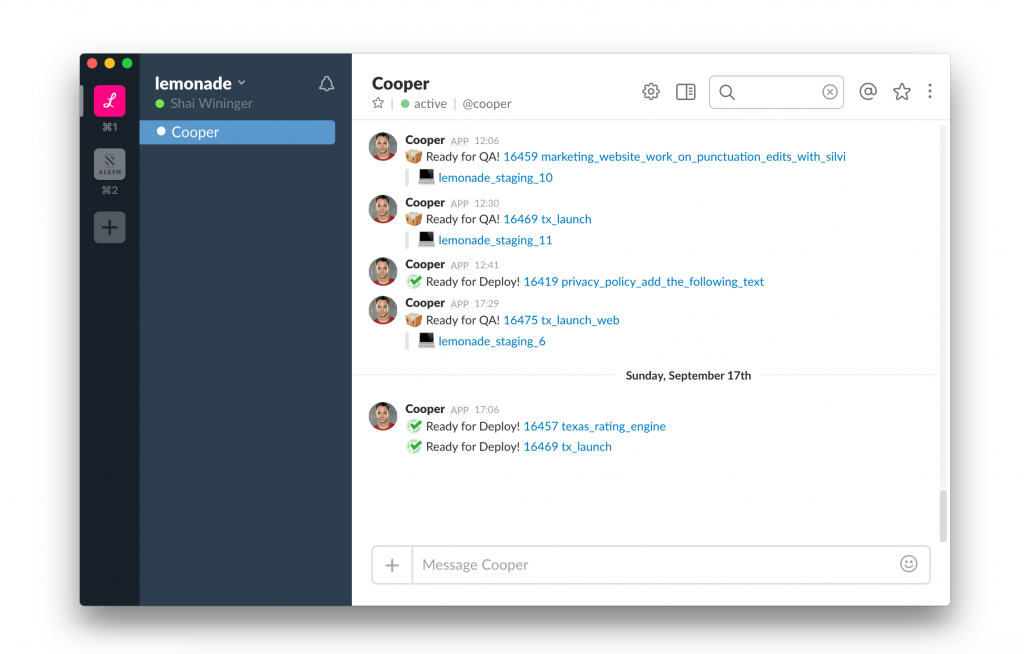

The ecosystem Maya and Jim inhabits is also home to employee-facing bots. An internal bot, Cooper, helps developers manage the workflow between product, engineering, automated testing, and QA.

“It assigns tasks to team members, prepares testing environments in the cloud, runs tens of thousands of automated tests, and deploys everything to the hands of our customers when ready.”

In some ways, Cooper represents an inflection point.

When an organization has technology unified by a design mindset and fully integrated into every aspect of business, the stage is set for designing and launching internal applications that can redefine productivity.

For this small insurance company — Lemonade lists fewer than 650 employees on LinkedIn — Cooper represents the automation of entire teams within traditional insurance companies.

It’s hard to imagine that rivals like Allstate (around 45,000 employees) and StateFarm (58,000 employees and over 19,000 independent contractors) haven’t seen the writing on the wall.

The User-First and Technology-Second Advantage

To established organizations, the Lemonade example should be a bit terrifying.

It’s far easier for a new company to build itself up around a core of integrated technology than it is for an existing organization to restructure itself around technology.

Nimble newcomers like Lemonade know that technology products, experiences, and solutions need to be part of an ongoing feedback loop that incorporates customer research, data and analytics, design, and development in an atmosphere where iteration happens quickly and where better solutions are always being tested.

This requires an integrated, holistic strategy, which in turn requires an organization to be structured so that different departments are sharing information and a unified purpose.

At the heart of all of this is the understanding that, in a world that has become even more intertwined with technology in the time it took you to finish this article, this inverse relationship will continue to define the nature of customer experience.

Great experiences don’t just happen, they are designed. Organizations that are structured with this inverse relationship in mind will be far better equipped to design great experiences that solve high-level problems with minimal friction, which is really just the entry point in the digital-first era.